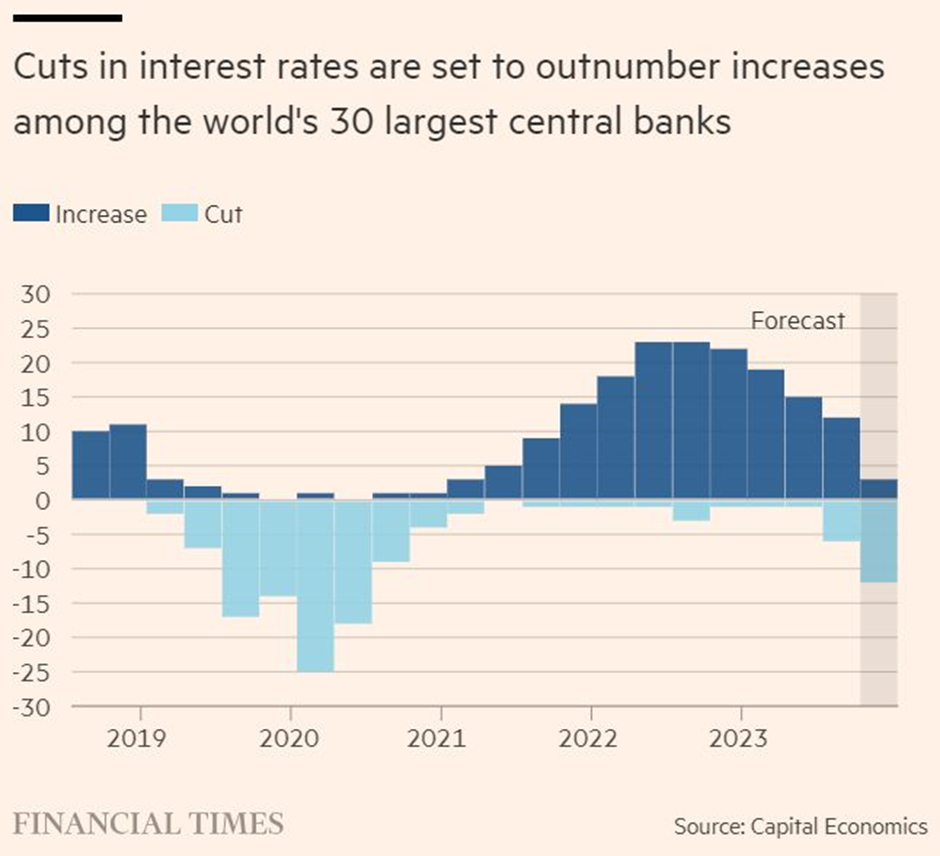

An interesting article I read from the FT. I concur with this forecast. Inflationary pressure, at least in the UK, was brought about by supply side issues exacerbated by the pandemic and the war in Ukraine, coupled with low UK productivity. As the impact of the war in Ukraine falls, we see inflation in the UK falling as well. The central banks decision to increase interest rates, a demand side policy, has increased borrowing costs for businesses at a time where it is essential for them to be investing in increasing productivity, a issue the UK faces in particular. As mentioned in previous articles, the rise in interest rates has had a negative wealth effect on households, as well as significantly reduced the disposable income of those with mortgages.

Rates will have to be aggressively cut in 2024 I believe, and I forecast rates being around the 3% mark by Q2 of 2024 in order to boost economic activity, which has been proven to be falling, this is seen by September’s purchasing manager indices, a key measure of economic performance, which indicated weakness in the UK and the eurozone.