It is almost like a gambling account at a casino. You have spent the first half of the year losing big and consistently, however the second half of the year comes, and you begin to win, small wins, but wins nevertheless, you feel richer, but are you? Well within the second half period yes, however if you expand your timeline, you are indeed poorer. This is a similar story to recent wage data. Headlines have been reading wages are up! However, real wages have fallen not risen, and the cost of living has increased steadily. According to the ONS, in the three months from February to April 2023, real total pay and real regular pay both fell compared to the same period in 2022 by 2% and 1.3% respectively.

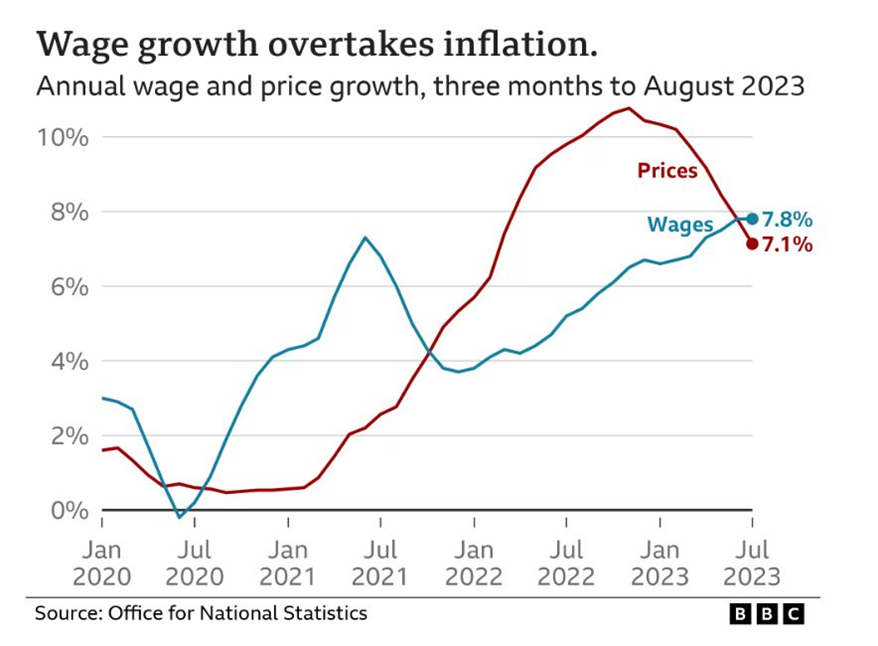

The ONS single-month growth rates adjusted for inflation, show a similar story, in April, both total and regular pay fell by 0.3% on the year. This is also supported by the Resolution Foundation, who projected “real incomes to have fallen in 2022/23 and then stagnated in 2023/24, which would mean a combined two-year fall in real household income of 4%.” Wage growth shows a similar story:

We should also look at labour productivity, which is low. Rising wages and lowering levels of productivity are not a good mix for the economy. Perhaps some firms will notice this and invest more in capital rather than labour to 1. Reduce their long-term costs and 2. Increase their productivity.

If this does occur on a macro scale, it will spell bad news for our economy, which, when looking at recent data, tells us that employment is down by over 200,000, unemployment is up to 4.3 per cent, and working age economic inactivity, is also up. Unfilled vacancies are falling; however, they are still nearing 1 million and many sectors still suffer labour shortages. – Another factor for increased wages and low productivity.

The rise in wages has not come become we are more productive, or indeed that firms are grossly more profitable, the rise in wages are needed to cover the rise in inflation, which is a supply side caused issue, as mentioned in my other posts. Wage increases are also needed to attract labour into the market, we are experiencing a rise in inactivity in addition, there has also been an increase in inactivity amongst workers over 65, which may partially reflect the decline in both self-employment opportunities and profitability. The students are the most worrying statistic, could we be facing a situation similar to China? Where we have large numbers of students who experience, and skill set does not match the demand in the economy.

Despite wage growth, unemployment is up, job vacancies in the UK have decreased by 43,000 to 988,000 between July and September. At a more micro level for example, the real estate sector in terms of job availability, dropped nearly 30% compared to the previous quarter – Where do these workers/ potential workers go? Real estate is not low skilled work, and in many cases requires years of study and money spent gaining qualifications, how do we transition these workers back into the economy?

Will this increase CPI – In my opinion no, we should think about marginal propensity to save over marginal propensity to spend – Times are hard, we have had one of the biggest falls in household disposable income, people who receive more from their wage will be more likely to save what they can, build back up their pots, rather than spend it all, meaning a low impact on prices.

Highest rise in wages come from the health and social care sector, as well as public admin, comparative to other jobs in the economy, these are not high earning jobs, and therefore does not support the notion that this would increase inflationary pressure and require another hike in rates. In addition, the increase in wages only closes the gap between the real loss in income through years of austerity in the sector, meaning that those workers are no better off than they were previously.