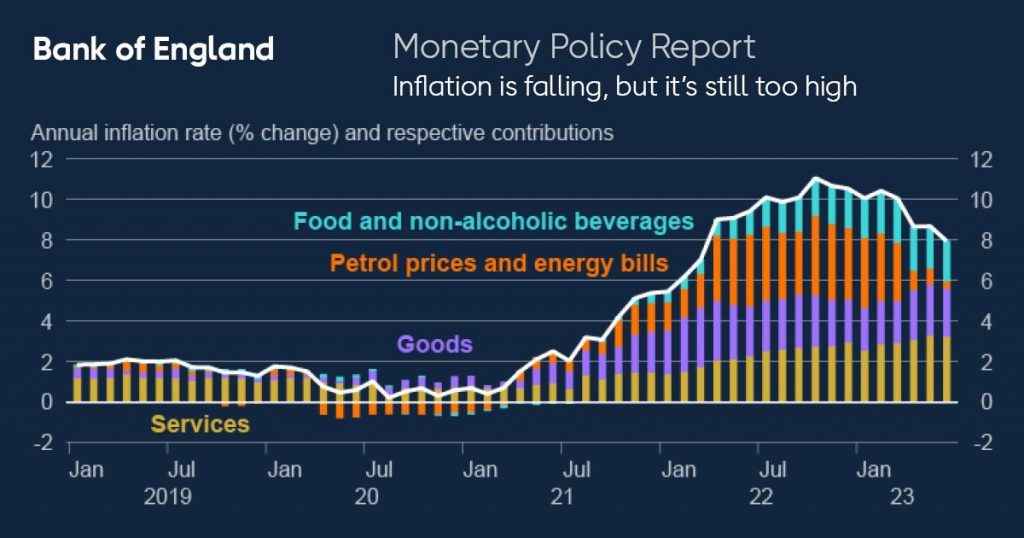

An interesting article from the Bank of England on their analysis on UK inflation, however , while their analysis of course holds merit, they seem to be reluctant to acknowledge Brexit as part of the reason for our inflationary pressure. Brexit has increased exporting and importing costs, increasing the cost of production for firms and decreasing their profits. As a result, firms have less money to spend on R&D which would improve the UKs failing productivity, and the rising cost of production is inevitably passed on to the consumer – both factors increase inflationary pressure, not to mention a huge drop out of our pre referendum exchange rate.

The BoE has also stated a ‘big fall in people available to work’ as a factor and have attributed this to the pandemic, leading to firms having to incentivise people to work through higher wages. However, again, they have neglected to include the prodigious affect Brexit has had on our labour market shortages. Not only in law, but also in the sentiment felt by many coming/trying to work here from abroad. Would tax relief on individuals/businesses not have been a better intervention?

The BoE has also admitted that falling energy prices have been the ‘main factor’ in falling inflation, if that is the case, why have they been punishing businesses and individuals, with record high base rates? Base rates i believe, which will HAVE to be aggressively cut in the years to come as it was a mistake to increase them so much in the first place. I look forward to watching the space as the years roll on to see if my prediction comes true.

To view the whole Bank of England post, please follow this link https://www.linkedin.com/posts/bank-of-england_inflation-activity-7092826939039604736-ZV8m?utm_source=share&utm_medium=member_desktop