There is a long list of explanations for this, however I believe there are 5 main reasons, a lot unfortunately a lot are attributed to Brexit.

- Productivity – Productivity in the UK is low, earlier this year, the BoE forecast a “weak outlook for productivity in Britain, with growth in output per hour worked averaging 0.25 per cent a year over the next three years, down from 0.75 per cent between 2010 and 2019 and two per cent in the decade before the 2008 financial crisis”. When a workforce is more productive, it produces more goods & services at a lower cost pert unit, as a result, this puts downward pressure on prices and consequently, it is linked with lower inflation.

- Inflexible Labour Market – Leaving the EU also meant changes to the rules on the free movement of labour and the introduction of a points-based immigration system. The freer movement of labour in the UK from the EU has reduced our labour flexibility and made us less able to react to shortages and shifts, as well as limited potential transfer of ideas which may improve productivity, this may also account for why we are experiencing higher wage inflation also, as firms must increase wage rates to attract labour. A study by the think tanks Centre for European Reform and UK in a Changing Europe found that there are “330,000 fewer workers in the UK as a result of Brexit”.

- Investment – Investment levels in the UK are low as businesses remain wary of the outlook for the economy. Investment in 2016 was not at its best, however, according to analysis by Think Tank in the UK in a Changing Europe, if it had continued its pre-referendum trend, it could be about “25% higher than it is now”.

- Energy– The US has it’s own fuel and therefore has been less affected by the war in Ukraine

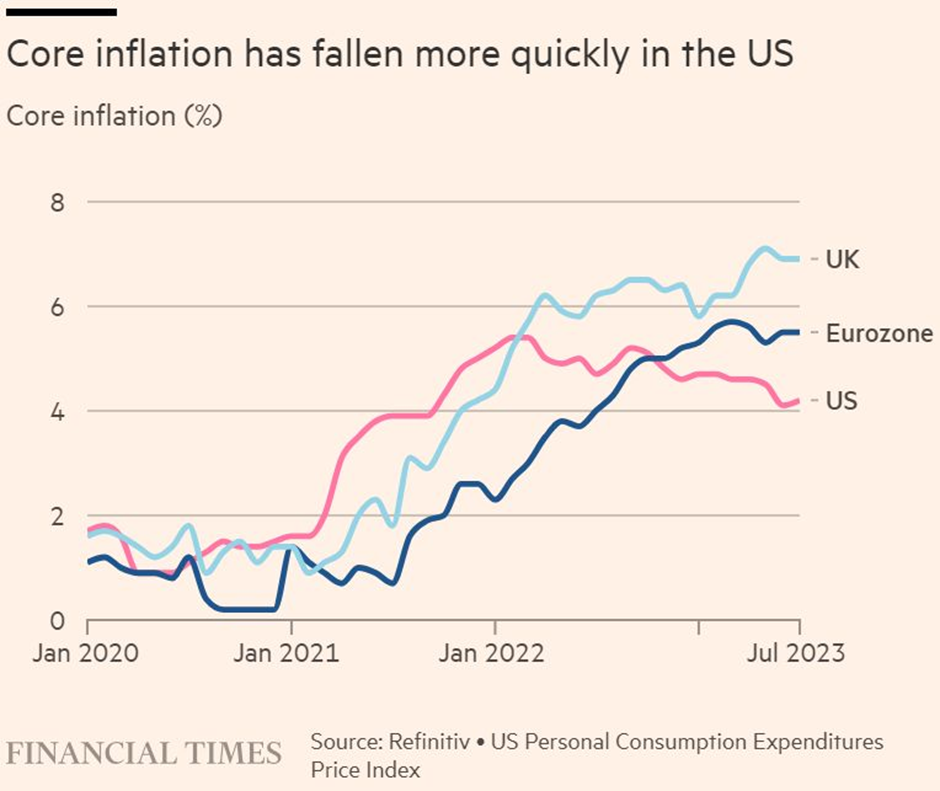

- Policy– The US began aggressively increasing rates earlier than the BoE, meaning it’s affects are feeding through to the economy already.

There are certainly more factors, and I would be keen to hear your thoughts!