Employers added 336,000 jobs in September, almost double the 170,000 estimated, according to figures released by the Labour Department.

Economists in the US argue that job creation will put upward pressure on the wage level, giving ammunition for the ‘higher for longer’ argument and for another rise in interest rates from the FED. For example, “Seema Shah, chief global strategist at Principal Asset Management agreed the Federal Reserve would “need to respond with more rate hikes”, saying the figures reinforced the “higher for longer narrative”” and Brian Coulton, chief economist at ratings agency Fitch, said the strong jobs growth would “keep upward pressure on wages, making it more likely that the Fed has further to go in raising interest rates”.

However, I have a contrary view to the data.

US Job data suggests that more people in the economy are being employed, regarded as a positive indicator for the economy, and an implication that the Fed may once again raise interest rates.

I would argue a different picture.

From a nominal point of view, yes, job data is positive, however if we look just a little further into the picture what we find is an increase in PART TIME workers of 151,000 and a loss of 22,000 full-time workers. To me, this indicates that Americans are losing full time stable jobs (and income) and are being forced to take up less secure part time work, as well as some individuals taking 2nd and 3rd jobs to put food on the table.

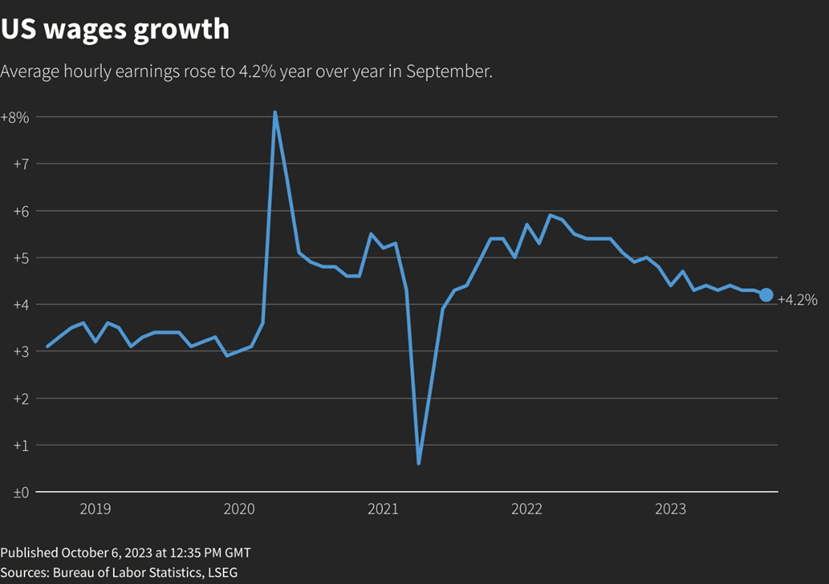

We must also investigate the industries where this growth is coming from, the bulk of the increase in payrolls was led by the “leisure and hospitality industry, which added 96,000 jobs”. Restaurants and bars also made a significant contribution, with 61,000 positions created, returning employment in the sector back to its pre-pandemic level. Could this simply be a market correction? Both industries also provide comparatively low paying jobs in the economy, going against the argument that this job growth data should be used as an indicator or argument that another hike in rates is needed. This is reinforced by wage growth data, which in the broader picture is slowing, please see the chart below:

My conclusion:

- Wage growth is in fact slowing

- Job creation is coming from traditionally low paying industries, an argument against the ‘hike’ in job growth will put upward pressure on wages.

- The job data shows the bulk of the growth comes from part time work with 151,000 jobs created and a loss of 22,000 full time positions. Indicating to me that US workers are taking up less stable income as well as some taking up 2nd and 3rd jobs to put food on the table.

- The bulk of the rise in job growth could simply be a correction in the market from industries heavily impacted by the pandemic.

This was a very insightful article. Well-written and straight to the point. I came here from LinkedIn and was very pleased to read the full thing and to see that it was of quality.

Adrian, Thank you very much for you comments and i’m glad the post was of interest to you! I hope you enjoy the more posts to come!