First off, what is a bond yield?

A bond yield is effectively the interest rate on a bond. The yield has an inverse relationship with the market price of a bond. When bond prices are rising, the yield will fall. When bond prices are falling, the yield will rise. The yield of a bond is set by the market, not the central bank.

Impact on US/Global economy:

- Higher real returns are negative for borrowers and existing asset holders, including the government, though positive for savers.

- Heavily debt-financed corporate firms face higher rates. Corporate debt relative to GDP rose significantly during and after the pandemic, exacerbated by comparatively cheaper loans. As mentioned in my previous post, this creates an unsettling future for those who are refinancing next year at significantly higher rates. Consequently, firms will have to look to cut costs and investment, damaging employment and productivity.

- As bond yields rise the government issues debt at higher rates, making it more expensive for the government to borrow. This is amidst record high US government debt, currently standing at over 120% of GDP.

- As bond yields rise government bonds become more attractive to investors, reducing investment in the private sector.

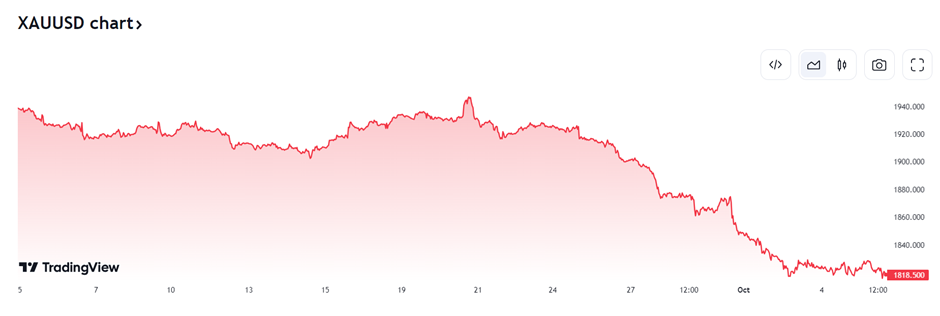

- As bond yields rise, this also detracts investors away from lower yielding assets, such as precious metals, resulting in a decline of their price, as well as reducing the share price of mining companies, to name one example. This can be seen recently in the gold market on the chart below:

- Higher US real rates make US financial assets more attractive, which plays out in the FX markets by lowering prices on currencies/commodities against the dollar, putting upward pressure on foreign inflation and interest rates.

This does however present an opportunity for those in emerging markets who export heavily to the US. As the dollar’s value rises, it makes buying abroad comparatively cheaper which should result in an increase of those exports to the US.