have been posting on UK inflation and interest rates since the hikes started happening and have made many arguments against the BoE pursuing demand side policy to tackle supply side issues. The conclusion of my argument, and still is, is that the BoE will be forced to cut rates aggressively as the supply side issues caused by the War in Ukraine and the pandemic being to wade. Inflation has fallen in spite of rate hikes, not because of them. Now is the time that the picture will become clearer and with new CPI data being released tomorrow, I thought I would share this post.

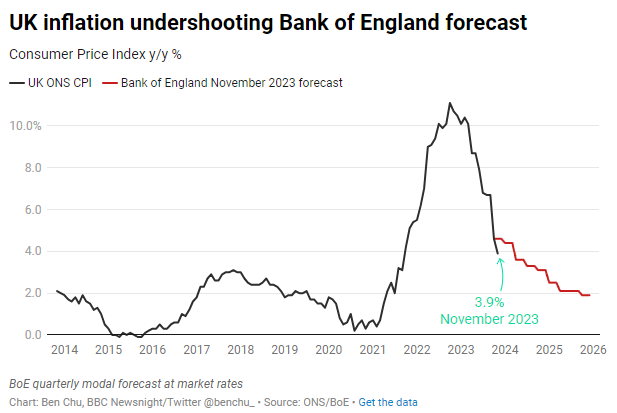

The BoE expected inflation to average 4.6% in Q4 of last year. What data showed however, is UK inflation at 3.9% in November and if the trend continues, I believe the inflation target of 2% could be hit as early as Q2 of 2024!

Data released on Friday suggests UK GDP growth was 0.3%. Whilst this means we are avoiding a technical recession; UK growth is stagnant. Combined with low productivity and a tight labor market, I believe the BoE will have no choice but to start aggressively cutting rates, potentially as early as Q1, likely Q2 and latest Q3. Cuts should be at a minimum of 0.25%, however cuts of 0.5% are also likely.

Looking at notes from the MPC report in November, they highlighted two key issues that may put upward inflationary pressure on the UK and may stand as an argument for keeping rates higher for longer. The two factors mentioned were wage growth and tensions in the Middle East.

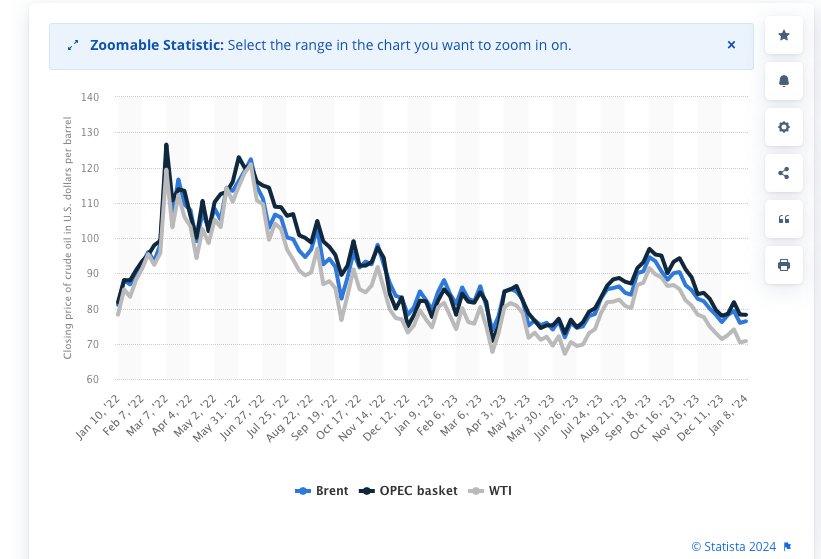

To comment on the latter, unless sustained, current tensions in the middle east/Suez Canal are unlikely to cause any significant shocks on the economy and prices. The effect of these supply side shocks has a lag effect and will therefore take some time to play out into the economy. Given more significant disinflationary factors, as well as the limited time scope/nature of the current issue, it is unlikely that this will have a significant impact on inflation. The chart below shows that whilst tensions are far from over, middle east supply issues have had little impact on oil/petrol prices in the UK.

Addressing wage pressure, starting salaries have indeed increased in the labor market, due to competition for skilled workers (worsened by current government policy restricting the free movement of labor from abroad), however candidate availability is also increasing reducing the potential impact of inflationary pressure. This is supported by recent data, in November the BoE expected pay growth to fall to about 7.25 per cent in the fourth quarter of 2023. Instead, what we have seen is wage growth declining to 6.5%. This not only limits the argument by the mpc that wage growth is an indicator to keep rates higher for longer but is actually an argument that rates need to be cut, wage growth is slowing however the cost of mortgages, debt and other interest-bearing liabilities for households is higher than ever.