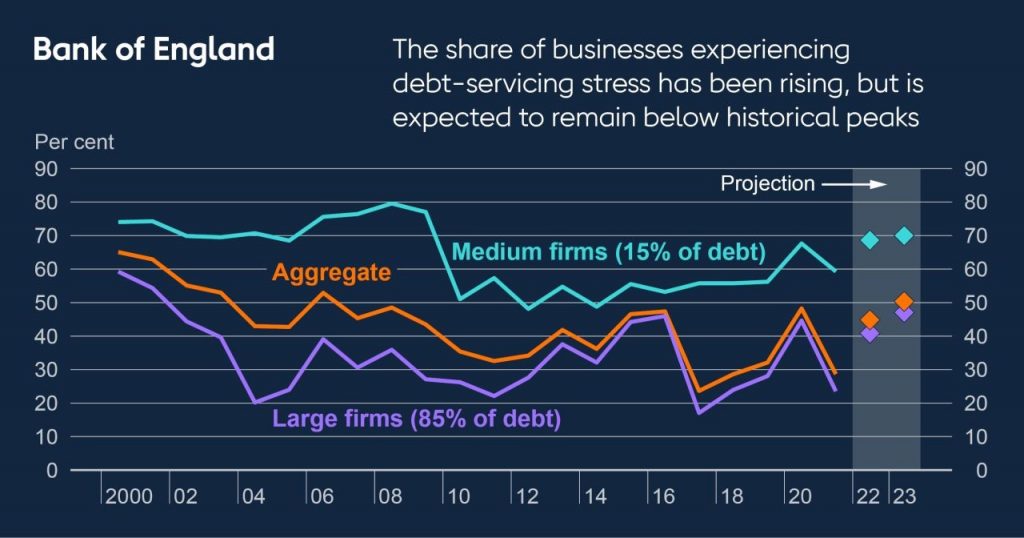

☎ The Bank of England has warned that rising interest rates are putting British companies at higher risk of corporate defaults, with the proportion of non-financial companies experiencing debt-servicing stress expected to hit 50% by the end of the year, up from 45% in 2022.

The proportion rose to 70% for medium-sized companies, meaning corporate debt stress would hit its highest level since the financial crisis of 2008-9.

The Federation of Small Businesses, said the analysis had mainly focused on bigger firms and “so doesn’t show the whole picture, with small businesses far more exposed to rising interest rates than their medium-sized and large peers”.

The effects on firms themselves will be simple:

⭕ Firms will certainly employ less people and may have to also reduce their workforce, the knock-on effect on the economy will of course be lower levels of employment, consequently, disposable income for affected households will be reduced, creating a negative multiplier effect on businesses as consumption falls.

⭕ Firms will reduce their levels of investment in training and R&D. This will further decrease UK productivity and output. As a result, our goods and services will become more expensive domestically and internationally, lowering the consumer surplus and negatively impacting our deficit in goods on our balance of payments.

There are a few policies that could potentially ease the strain;

⭕ Reducing base rates for one (we are heading in the opposite direction)

⭕ Government investment in failing areas- The government is trying to pursue this currently through forcing pension funds to increase their holdings in small UK businesses and start ups

⭕ Tax Cuts

I would be interested to hear any other thoughts as to what policies could also combat this situation!