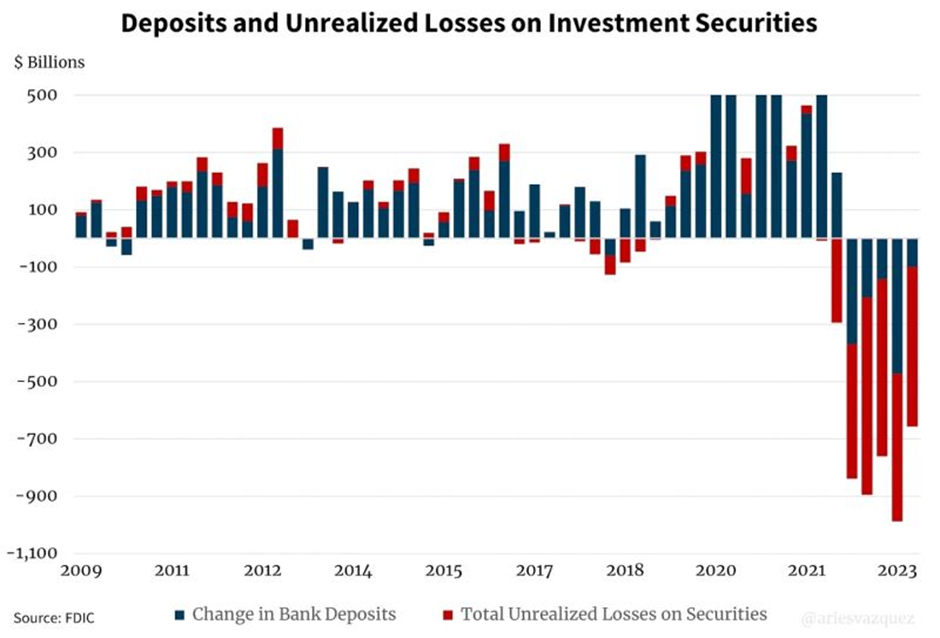

Unrealized losses on investment securities held by US banks is now at $558 billion, up 8.3% from the previous quarter. In addition, bank deposits have also declined for a fifth consecutive quarter.

This creates a real liquidity risk in the US banking system.

Potential impact on economy:

1.Decline in funds for investment

When banks face low levels of liquidity, they will be less able and willing to lend money to firms and consumers, especially in areas where investments are seen as ‘risky’. As a result, firms who wish to borrow money for investment purposes may find it very difficult to get a sufficient loan. Consequently, we may see a reduction in investment and the firm level and also employ fewer workers. If the fall in investment level is significant, this will lead to lower economic growth and higher unemployment. Investment in the US accounts for approximately 17% of GDP ( St Louis Fed) , presenting a significant threat to economic activity. Exacerbated of course, by a potential negative multiplier effect. This also comes at a time where large levels of investment are needed to meet expectations of sustainability, notably in the vehicle and energy sector.

2. Confidence

Any banking crisis will have an impact on general economic confidence, both domestic and foreign. News about a banking crisis will tend to make people more risk averse. Consumers will opt to save rather than spend. However, if consumers fear savings are not safe in a bank, they will also switch to keep savings in cash, rather than the bank, which we can see is happening from the chart above.

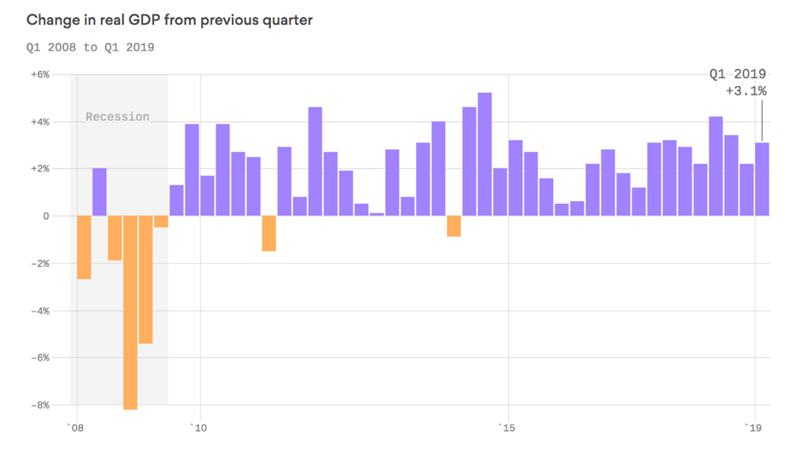

The clearest picture of this is of course in 08. I will use data presenting US consumer confidence, against data of US Economic growth. Showing an almost mirror image.

From the charts above, at the start of the 08 banking crisis, we see a significant fall in consumer confidence. As consumer confidence falls, consumption decreases, therefore there is less demand for goods and services. As demand for goods and services fall, firms produce less and typically respond by laying off workers. Firms may also have to close, causing a significant increase in unemployment.

In conclusion, signals of the impact of this liquidity issue would be lower levels of investment, lower consumption, lower economic growth and higher unemployment and lower bank deposits ( which we are already seeing).