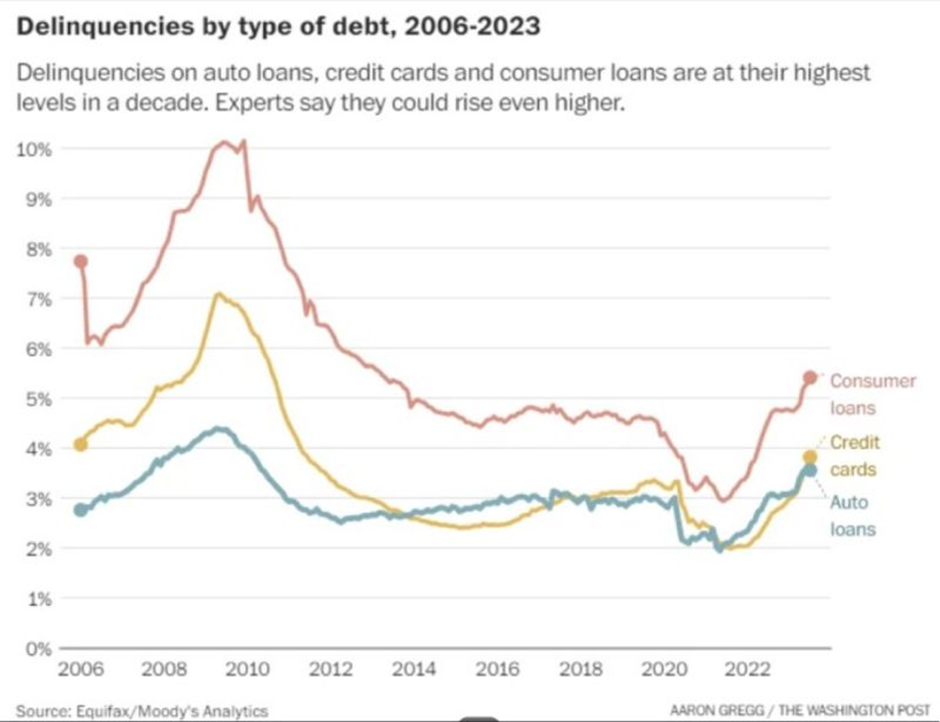

📈 Debt delinquencies in the US are rising.

Debt delinquency occurs when a borrower misses a payment on a loan. This is usually followed by high fees and legal complications.

A few potential impacts for the future:

The value of debt products/instruments may fall, creating a potential liquidity issue for financial institutions as they hold unrealised losses on their sheets. This may also impact the ability and willingness to lend by institutions. As they see an increase in consumers failing to make payments, lending institutions may decrease their lending activity. Their response may be to push for more secured types of lending, this creates a dangerous landscape where households face losing assets to institutions or having to sell them to make payments. As households sell their assets, this increases the supply of those assets in the market, as a result, the value of those assets may fall, if other individuals do not react quickly, selling assets may not be enough to cover their outstanding debt. Households who hold similar assets may also see a decline in their ‘on paper’ wealth, potentially creating a negative wealth effect.

Data to look out for: Value of household/company assets, household savings ratio, and lending levels.