US CPI data came in hotter than expected yesterday, and the markets reacted by pricing 2 rate cuts by the end of the year instead of 3. I’ve even heard some commentary that rates could even be put up!

But why is the US holding off on cutting rates and should the UK follow suit?

The short answer is no, and while I could go into immense detail, I thought I would make this a quick read.

1.The FED for one does not want to lose credibility. If the FED cuts before 2% they are worried it might not fall below and continue to stay below 2%, damaging their influence.

2.The US economy grew by 2.7% last year and is projected to grow by 1.8% this year. The UK however, in contrast, hit a technical recession and the HM Treasury average of new forecasts puts the UK at a projected ‘growth’ of 0.3% this year, which represents a stagnating economy.

3.US employment is near historic lows and they effectively have full employment. The UK however, is well below capacity.

In conclusion, the difference in terms of rate cuts between the US and the UK is that the US economy has growth whereas the UK is in recession and is projected to effectively stagnate this year. Our economy is well below capacity whereas the US is near historic low unemployment, so they need the economy to slow to be sure inflation falls to 2%.

In the UK however, rate cuts are needed immediately to promote economic growth, consumers as well as businesses are being crushed under the weight of current interest rates.

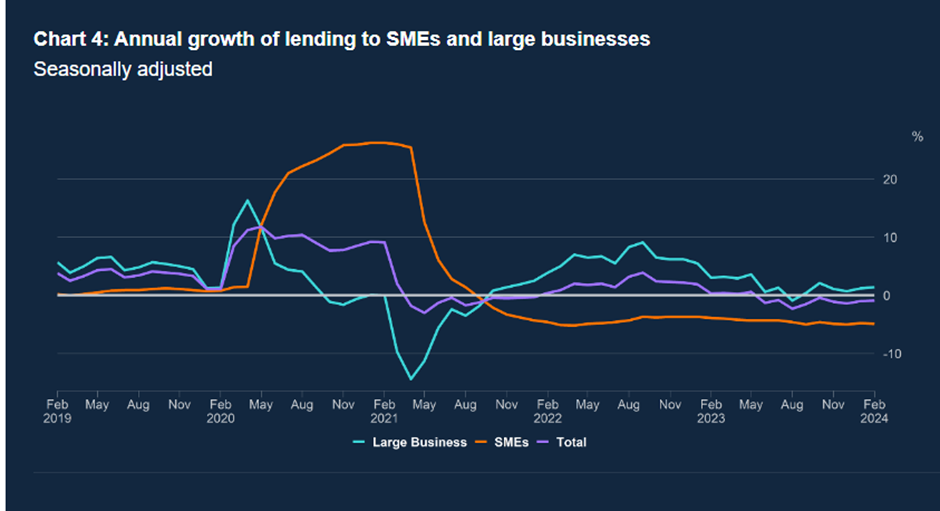

In February, UK non-financial businesses repaid, on net, “£3.3 billion of loans from banks and building societies (including overdrafts), compared with £0.2 billion of net repayments in January”. More specifically, large non-financial businesses repaid “£2.3 billion in February compared to net zero of borrowing in January”. Small and medium-sized non-financial businesses made net repayments of “£1.0 billion in February, compared to net repayments of £0.2 billion in January” – (Bank of England).

Effectively, businesses have been repaying loans since September 2021,and until this changes, it is hard to forecast any sustainable growth in the business sector. Although there are some signs that manufacturing activity bounced back in January, it’s only sustainable if there’s an investment taking place to grow productivity and output. Part of the reason is that borrowing costs for SMEs remain high. The average price of new borrowing from banks and large firms fell four basis points in February 2024 to 6.97%. However, the rate of new loans to SMEs increased by five basis points to 7.55. . In 2023 SMEs employed 16.1 million people, which accounted for 61% of employment in the private sector. Addressing this issue is therefore key for the UK to get back to growth.